Bettered National Insurance

NATIONAL INSURANCE SYSTEM

NATIONAL INSURANCE SYSTEM

Better National Insurance Fund and contribution system

Better National Insurance Fund and contribution system

WOMEN FROM AGE 60 TO STOP PAYING

NATIONAL INSURANCE

WOMEN FROM AGE 60 TO STOP PAYING

NATIONAL INSURANCE

Remembering that although this means worker National Insurance contributions would end at age 60 for 1965 born women onwards (and ladies over 60 born 1960 to 1964), bosses still keeping paying employer National Insurance contributions no matter how old you work.

Men's pension age could be reduced to 65 in 2025, so stop paying worker National Insurance contributions, need new law which takes year to reduce men's pension age from 65 to 60.

INCREASE WORKER NATIONAL INSURANCE ON TOP WAGED

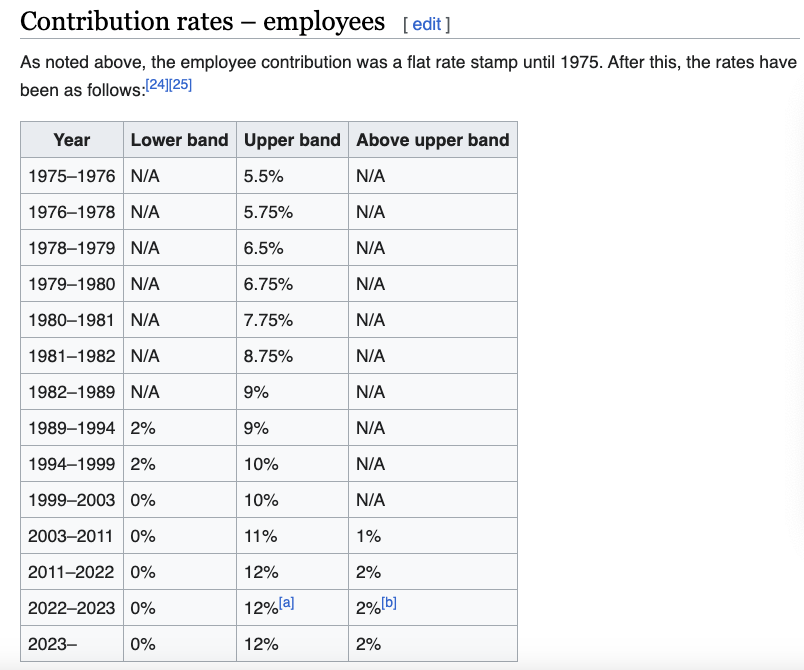

- Increase worker National Insurance contributions on wages from £71,271 from current 2 per cent to 10 per cent, using name Upper Earnings (and adding name threshold).

Instead of the current frozen maximum salary threshold for worker National Insurance contribution rates of £50,271 that equates to current 40p higher rate income tax rate. - Have further threshold of worker National Insurance contribution rate, using name Maximum Salary threshold,

on wages from £200,271.

- Pay 12 per cent worker National Insurance contributions from maximum salary threshold threshold of £200,271 wages upwards

(now only paying 2 per cent).

OTHER SOURCE OF INCOME INTO NATIONAL INSURANCE PENSION SCHEME

- Bring back Treasury supplement at its pre-1981 level of 18 per cent of contributions.

- Source: the late Tony Lynes.

LOWER WORKER NATIONAL INSURANCE on

WORKING CLASS WAGES & FOR BOSSES

WORKING CLASS WAGES & FOR BOSSES

- Reduce worker National Insurance contributions to

5.85 per cent of wages between £15,230 (unfrozen new personal tax allowance with us in government) to £71,270 a year. - Lower bosses' employer National Insurance contributions from

current 13.8 per cent down to 10 per cent.

* Basic income tax allowance would increase

£500 per year from April 2026, with our new government.Up til and including age 49, after which higher age related tax allowance of £3,000 on top of personal income and National Insurance tax allowances from age 50.

SELF EMPLOYED AND NATIONAL INSURANCE

- Class 4 National Insurance credits for profits below £15,230.

- Class 4 National Insurance contributions of 5.85 per cent on profits between £15,230 and £71,270.

- Class 4 National Insurance contributions of 10 per cent on profits over £71,271.

Current rates (April 2024) of Class 4 NIC are -

- 6% on profits between £12,570 and £50,270

- 2% on profits over £50,270.

- It is up to our party's tax accountant consultants, to simplify tax system so are real world tax bills each year for self employed.

NATIONAL INSURANCE AND

WORKING AGE BENEFITS

WORKING AGE BENEFITS

(UK resident Citizen and

non-citizen with permanent right to live and work in UK)

non-citizen with permanent right to live and work in UK)

- End National Insurance (NI) Lower Earnings Level.

- Replace with automatic National Insurance credits granted from first £1 of income, in or out of work or 'economically inactive' (neither in work nor on benefit), up to wage level of starting threshold for

National Insurance contribution worker payment.

- Entitles you to state pension and

working age benefits. - Gives right to Statutory Sick Pay to lowest waged, majority of which are women.

NATIONAL INSURANCE FUND

WILL ONLY BE FOR STATE PENSION

WILL ONLY BE FOR STATE PENSION

- All the other things than for the state pension that National Insurance Fund contributions have been for, to move into general taxation for funding (as the rich earning over £80,271 a year will pay more income tax).

- Worker and employer National Insurance contributions to be only for state pension (renamed National Insurance Pension).

- Redundancy for workers of private firms that go bankrupt, to come from assets of the company, as first priority before all others the company owes money to, and not from National Insurance Fund.

- Benefits such as Incapacity benefit, widows' benefits, maternity allowance, guardian's allowance and Jobseeker's Allowance

would no longer come out of National Insurance contributions,

but from general taxation, whether income tax or stealth taxes.

You are on BETTERED NATIONAL INSURANCE page