Summary of Pension Policies

£35,000 compensation to ladies born 1953 to 1959

Tapered compensation ladies born 1951 to 1953 & 1960+ born

Pension age 60 - 1960s born onwards

Works Pension age 50 - 1970s born onwards

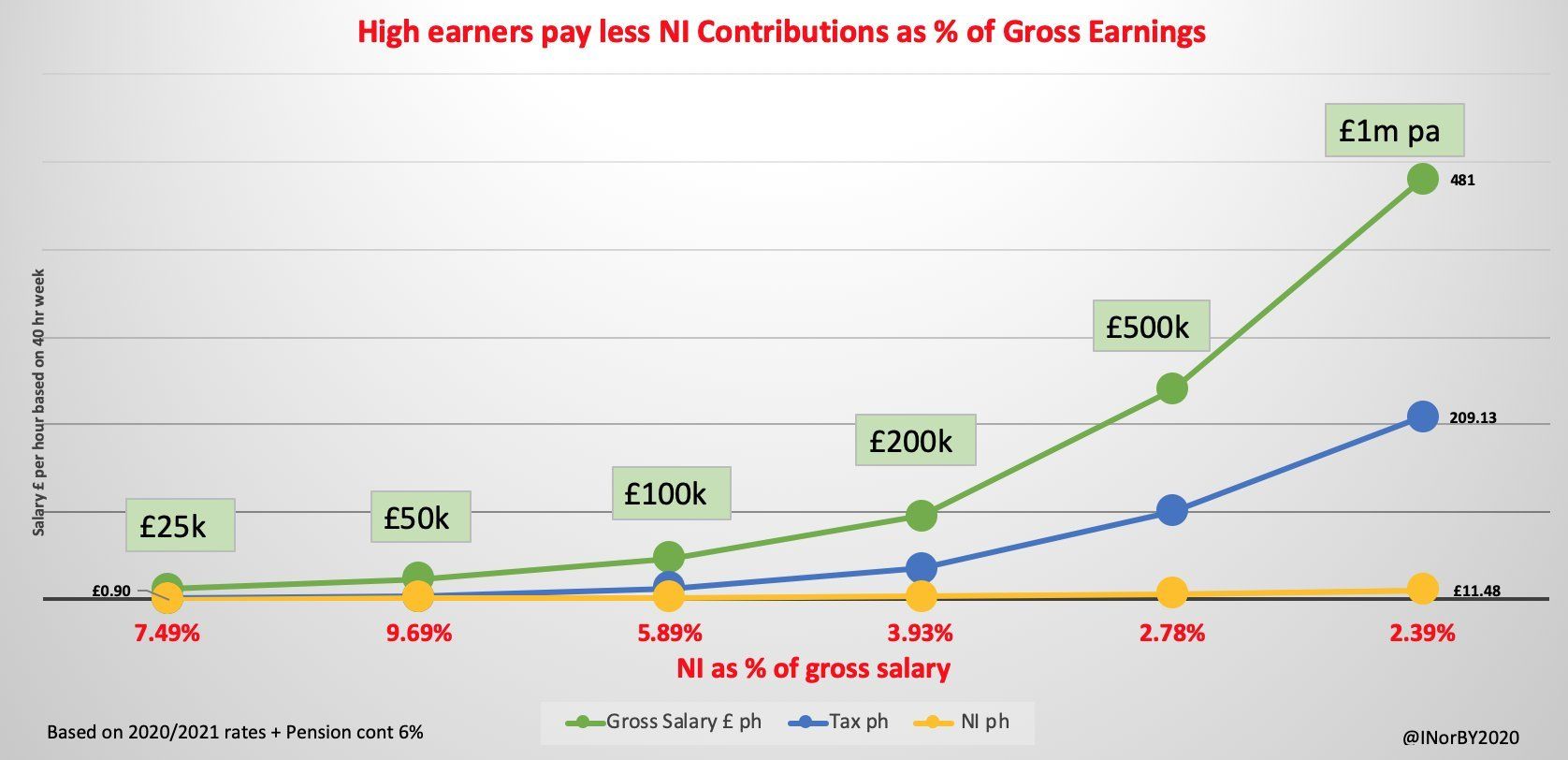

Bettered National Insurance by ending big NI tax break for top waged

Windrush Generation get full state pension, UK resident or deported

End Frozen Pensions for Brit Expats worldwide

Greatest Women's party in UK history

£486.55 per week state pension for all pensioners,

men and women,

old and new,

from age 60 to 100 plus,

same money regardless of National Insurance history.

Winter Fuel Payment £650 from age 60 onwards per household

Decent Pension

Less Tax

Lower Council Tax

Benefit without requirement to seek work

More National Insurance on rich

Lower state pension to age 60 and

increase state pension money, by

taxing the rich more in worker National Insurance contributions, on which they now only pay 2 per cent,

when you pay 12 per cent worker

National Insurance contributions.

Lower Tax

1.

State pension not deducted from your basic tax allowance

2.

Return of £3,000 higher age related tax allowance on top of your basic tax allowance, lowered to start from age 50.

3.

Lower Council Tax for all.

- Free Prescriptions in England for all ages, as have in Scotland, Ulster and Wales.

- Free Public Transport from age 60 throughout UK.

- Pensioner social bungalows built out in villages, with capped rents & low council tax.

- Right to pay cash in shops and businesses.

- Fully staffed cash tills in supermarkets.

- Free BBC TV licence for all ages.

- Discount Handyman service back, for disabled & elderly people for small home & garden jobs.

POLL TO SHOW MORAL SUPPORT

BY YOU REPLYING

YES SUPPORT,

PLEASE

Contact Us

We will get back to you as soon as possible

Please try again later