Non Clickable Image

Lib Dems Against Pensioners

Worst Pension Minister in State Pension history

(started 1908, first payment 1909)

(started 1908, first payment 1909)

between 2010 and 2015,

and directly caused the misery of especially women pensioners,

poorest pensioners and

1950s to 1980s born ladies.

Early Works Pension Lost 50 to 55

Early Works Pension age lost from 50 to 55 in 2010

Pension Age rise 60 to 65 & 66

1950s Ladies turning 60 from 2011 lost state pension from 60 to 65 - 66

Winter Fuel Payment Cut

Eldest got biggest cut from Winter Fuel Payment, never risen since

Button

Pension Credit Lost 60 to 66

Pension Credit Lost 2012 onwards for men & women from 60 to 66 and to Pensioner Husbands of women below pension age 66

Button

1950s Born Ladies

DEFAULT RETIREMENT – PENSION AGE RISE

The Employment Equality (Repeal of Retirement Age Provisions) Regulations 2011 was passed during former Lib Dem Pension Minister Steve Webb’s time as Pension Minister, and made possible pension age rise to men and women the same, but especially women.

PENSION AGE RISE

Lib Dems Pension Minister Steve Webb did not repeal (stop happening):

- Tory 1995 pension act (women’s pension age rise from 60 to 65),

nor

- the Labour legislation of 2004 Finance Act (early works pension rise from 50 to 55)

nor

- Labour's 2007 pension act (further pension age rises 66, 67 and 68).

WINTER FUEL PAYMENT TO THE VERY OLDEST

Neither did former Lib Dems Pension Minister Steve Webb raise Winter Fuel Payment after it was cut in 2011-2012, and it remained at the same inadequate rate since then. My old parents lost especially.

WIDOWS PENSIONS

Nor did Steve Webb (former Lib Dems Pension Minister) bring back Widows Pensions, stopped by Labour in 2002, before pension age 60, which could have been paid til new risen pension age. This would have especially useful during the pandemic now.

STATE SECOND PENSION (aka SERPs)

Former Lib Dems Pension Minister Steve Webb did not end the opt out from SERPs and bring back the state second pension, especially where he had direct power, for the majority of victims who worked in government and councils, who had no knowledge of SERPs. Mostly women.

Nor was their consent required to deny them the state second pension.

Most public sector workers are low or basic waged women, so would not have got much or any works pensions.

Source:

Sat 20 Aug 2005 The Guardian

https://www.theguardian.com/money/2005/aug/20/pensions.jobsandmoney

LOSING OUT BY OPTING OUT

Back in 2004, Which? (formerly Consumers Association) … “The watchdog said the results of its research showed that 71% of the 6.4m personal pension holders will lose out and the average payout will be 80% of what they would have received under the additional state scheme.

In the Which? study, those over 50 are the most likely to have lost out. Only one person out of 22 aged over 50 is on target to get a better pension by contracting out.”…

… “A spokesman said: "The really big losers are those who stayed contracted out after 1997. This year is important because it's when National Insurance rebates became age-related - the younger you are, the less rebate you now get."…

… “As an added incentive, until 1993, the government paid an extra 2% of your earnings into a private pension if you were contracting out for the first time.”…

… “Since 1997, when the rules changed again, the amount paid into them hasn't been enough to match what you would have got from the state.”…

WIDOWS INHERITING LESS STATE SECOND PENSION

Remembering from 2002 widows could inherit only 50 per cent of husband’s state second pension.

You Gov UK information … “The maximum you can inherit depends on when your spouse or civil partner died. If they died before 6 October 2002, you can inherit up to 100% of their SERPS pension. If they died on or after 6 October 2002, the maximum SERPS pension and State Pension top up you can inherit depends on their date of birth.”…

STATE SECOND PENSION LESSENING IN VALUE

… “SERPS was originally designed to give a maximum addition to the basic state pension of 25 per cent of a person's earnings between the lower and upper earnings limit. But the 1986 Social Security Act reduced significantly the value of SERPS for people retiring after 1999.”

… “For people reaching pension age in 2010, their SERPS pension will be at most 20% of their relevant earnings.

Widows (could) inherit 100% of their husbands' SERPS pensions, but for widows of people who die after October 2002, this is reduced to 50%.”…

Year 2000

Parliament publication

https://publications.parliament.uk/pa/cm199900/cmselect/cmsocsec/606/60608.htm

THE WEALTHIEST PAY LEAST

WORKER NATIONAL INSURANCE CONTRIBUTIONS

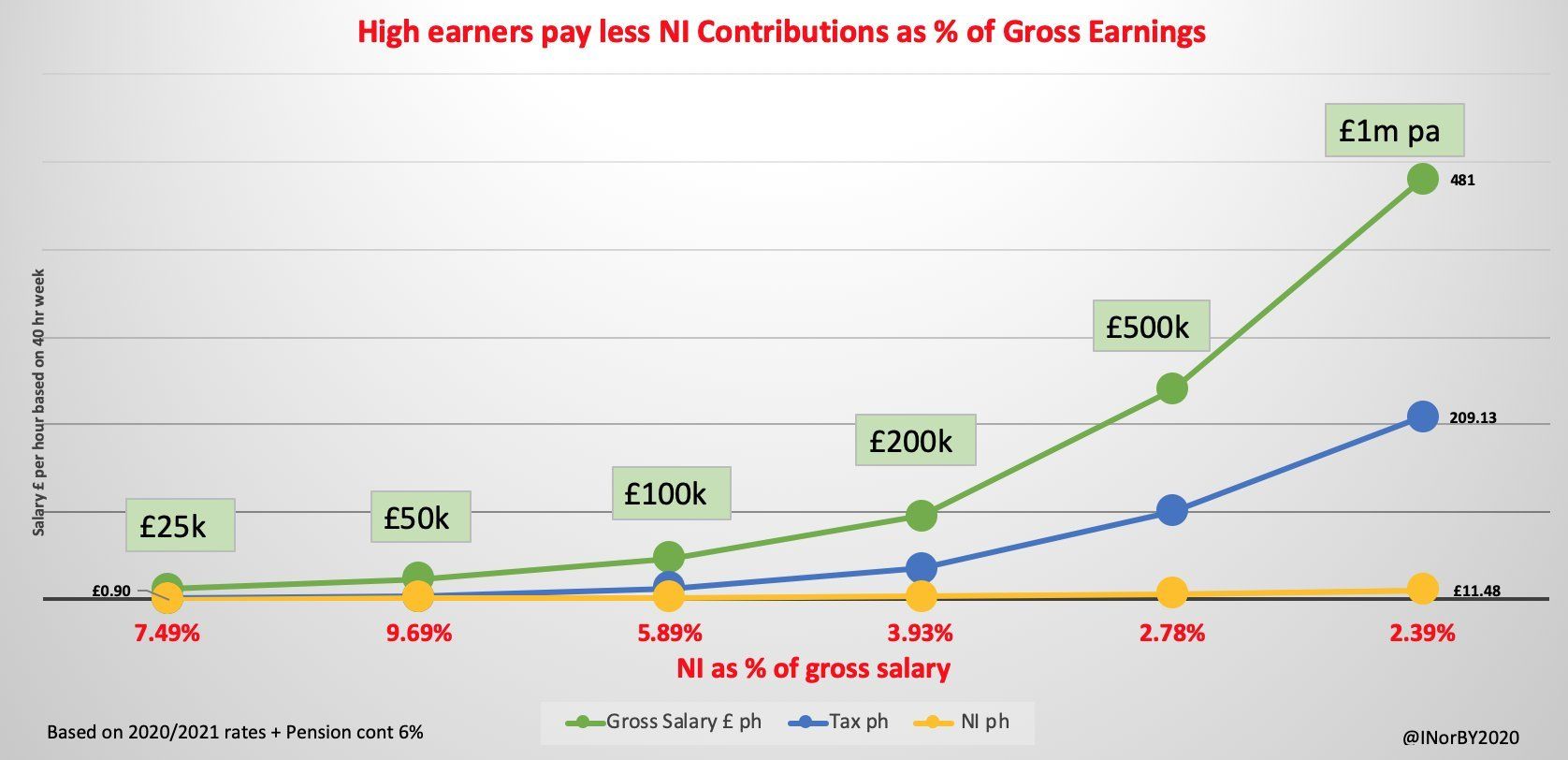

And remembering that above the upper earnings limit, worker National Insurance contributions rose from zero to 1 per cent, then during Lib Dems Pension Minister time in post, to 2 per cent on all further wages. SERPs did not end til 2016.

(2022 example, paying National Insurance contributions of 12% on earnings up to £50,270 and 2% on anything above that).

2009

Employees' primary Class 1 rate above upper earnings limit

1%

Source:

https://cwenergy.co.uk/national-insurance/

NEW FLAT RATE STATE PENSION IS NOT MORE MONEY

1950s born ladies retiring from April 2016, onwards

Former Lib Dems Pension Minister Steve Webb took money from the full new flat rate state pension (2014 pension act), despite the old basic state pension system being paid in full if you had 30 years National Insurance history, whether in the state second pension or not.

With raised requirement of 35 years National Insurance (itself discriminating against women, who had, had social history making it hard to get a full NI record) still did not get full new flat rate state pension (retiring from April 2016).

And will not for mostly women retiring for decades to come.

We got the full old basic state pension regardless of being contracted out of SERPs (state second pension).

But the new flat rate state pension takes money from the full amount, when SERPs (now called protected payment) is ABOVE the full rate, and not instead of the full rate.

Making the flat rate practically individual.

This, for example, lost Admin Grey Swans around £1000 a year for life from my full flat rate state pension, when I’ve got a few years more National Insurance history than the full 35 years, and 1950s ladies are losing out even if have the full NI contribution history of 50 years.

NIL NATIONAL INSURANCE CREDITS

Lib Dems Pension Minister Steve Webb kept the system of the Lower Earnings Level below which the lowest salaried (again, mostly women) did not get National Insurance credits granted by government, so had no access to state pension, made worse by new flat rate state pension system (2014 pension act) that granted no state pension if below 10 years National Insurance record.

LEL was kept separate for each job, even if a lady or gent had several part time jobs, that in the end totalled sufficient wages to be above the LEL.

INJUSTICE OF CLAWBACK

Steve Webb (former Lib Dems Pension Minister) ignored the Clawback done by banks and councils to mostly women employees, so that when the pitifully small state pension increased, their works pension is reduced, when the two have no connection whatsoever.

THE NEXT VICTIMS -

the 1960s born Ladies

Meanwhile, Webb’s 2014 pension act brought more 1960s born ladies into pension age 67 (from Labour’s 2007 pension act) and so now the loss of free prescriptions in England is from 60 to 67 and not as in newspapers from 60 to 66.

When Ulster, Wales and Scotland have free NHS prescriptions for ALL ages.

1970s Born Victims

Loss of Early Access to Works Pensions - Now Hitting 1970s born

HOW BAD Lib Dems Pension Minister between 2010-2015

to 1970s born -

There are men who have such poor knowledge of state pension, that they believe the Lib Dems are wonderful as ‘lowered’ ( lol ) early works pension age to 55, when Lib Dems

ROSE

early works pension from

50 to 55 in 2010, using Labour’s 2004 Finance Act, for men and women the same.

This is hitting the 1970s born, now turning 50, with highest ever redundancy rates by age, after the lockdown loss of jobs. Little chance of a new job due to ageist in job recruitment and certainly not at same wages as last job.

1980s Born Victims

Pension age 68 since 2007.

Former Lib Dems Pension Minister kept Labour's 2007 pension act, rising pension age to 68 for 1980s born victims onwards.

To Oldest Pensioners

Under Payment of elderly pensioners, mostly women since 1983

WHILE ABLE TO SPEAK FREELY WHEN RESIGNED, BUT NOW BACK BEING PENSION MINISTER

In FT Adviser’s article headed ‘Opperman blames Webb for state pension errors’, ...

…”Pension minister Guy Opperman has blamed Sir Steve Webb for the litany of state pension failures the Department for Work and Pensions is now dealing with.

At a Work and Pensions committee hearing on

July 6”… 2022

…”total of 134,000 pensioners — 90 per cent of whom are understood to be women — being underpaid state pension entitlements to the collective tune of £1bn.”…

With Opperman saying …if "Sir Steve (...) had addressed some of the problems I'm now having to deal with”…

…”Opperman … wishes his predecessors had addressed this, including Webb, “who was pensions minister for five years under the coalition, who shadowed it for many years, and actually reformed the state pension in great detail”.

“I wish he had reformed and fixed the problems I'm now having to deal with and that he wasn't sitting on the side-lines being paid huge amounts of money to be a critic, and a journalist, casting aspersions against the people who he employed as minister.”…

…”He added: “I wish he had done his job better when he was a minister and I wouldn't have to clear up his mess afterwards.”…

PENSION CREDIT

Former Lib Dems Pension Minister Steve Webb did not uncouple Pension Credit from women’s pension age, so wasting welfare admin budget in Jobcentres on people with no hope of a new job, by ageism in new job recruitment by bosses.

This resulted in a 100 per cent increase of men and women from age 60 on working age benefits, where they end up for years, probably til raised pension age.

Certainly, on constantly re-assessed sick and disability benefits, so adding to the admin costs.

Especially, as this also meant that pensioner husbands could not claim Pension Credit even for themselves, despite being the right age, and both him and his wife on the constantly re-assessed Universal Credit.

FREE UNEMPLOYMENT BENEFIT AND FREE NATIONAL INSURANCE CREDITS

Former Lib Dems Pension Minister Steve Webb did not apply the equality of granting automatic National Insurance credits to women, that had been offered to men since 1983 and granted right up to 2018, between ages 60 to 65 to men.

Also men could claim unemployment benefit without requirement of seeking work between 60 to 65, something not offered to women, who lost state pension and pension credit from age 60 since 2011.

Us 1950s ladies turning 60 in 2014, who lost state pension from 60 to 65 (then 66) suffered loss of such automatic National Insurance credits to women.

But of course, once women had begun losing state pension between 60 and 64 from 2011, women were losing out to men in automatic National Insurance credits.

No-one offered me, as a woman, unemployment benefit between 2010 and 2018 without need to seek work. Most of that time was under Lib Dems in coalition.

That also could have been a source of National Insurance credits.