Lower Pensioner Tax

Income Tax & Pensioners

Income Tax & Pensioners

Already pay a lot of tax in money spent and bills you pay

Already pay a lot of tax in money spent and bills you pay

Taxes on money spent and bills paid, are called indirect or stealth taxes.

Less tax to pensioners means more of their spending money (aka the Grey Pound) in town high street shops and cafes, as women aged over 50 are the majority of customers

in town centres

in town centres

STATE PENSION AND INCOME TAX

- Paid state pension tax free, meaning not deducted from your basic tax allowance. Monthly state pension would be £1,600 (448.12 per week).

- State pension is paid 52 weeks a year, so would be £20,800 a year.

- Paid compensation tax free, for loss of state pension, by pension age rise, to 1950s and 1960s ladies, so does not mess up your tax code.

STATE PENSION AND INCOME TAX

- Paid state pension tax free, meaning not deducted from your basic tax allowance. Monthly state pension would be £1,600 (448.12 per week).

- State pension is paid 52 weeks a year, so would be £20,800 a year.

- Paid compensation tax free, for loss of state pension, by pension age rise, to 1950s and 1960s ladies, so does not mess up your tax code.

RETURN OF AGE RELATED TAX ALLOWANCE

- £3,000 age related tax allowance, on top of your basic tax allowance,

from age 50 for UK residents.

(New lowered starting basic tax allowance rate of 10p instead of 20p starting from £12,571, up to £40,270).

WORKS PENSIONS

Tories will freeze the Lifetime Allowance, currently, £1,073,100 in your works / private pension for 5 years, til April 2026.

- Background

Analysis by Aegon pension industry shows, for example, a saver who withdraws cash from your works / private pension in a lump sum would lose an extra £180,125 to the taxman by 2025. This is the difference on the tax payable between frozen lifetime allowance and the £1.4m had the sum been unfrozen.

Over 50s party in government would:

- Not Freeze your Lifetime Allowance on your private / works pensions.

- End Lifetime Allowance and yearly allowance.

CASHING IN PENSION POT

- End cashing in your full works / private pension as a lump sum (save those who have to buy an annuity to get a monthly paid pension for rest of your life) so saving you from your retirement money being taxed more. But even more to protect pensioners from the high increase of scammers thieving your pension money.

- Continue the tax-free lump sum of up to 25 per cent of your works / private pensions.

- Save tax by no longer able to cash in 75 per cent as lump sum of your works / private pension, and get that percentage as your monthly paid retirement pension.

KEEP MARRIED COUPLE's ALLOWANCE

YOU BORN BEFORE 6 APRIL 1935

IF ALREADY CLAIMING IT

IF ALREADY CLAIMING IT

For very oldest married couples where you or your partner were born before 6 April 1935, you have Married Couple's Allowance (MCA). You cannot claim both MCA and

Marriage (transferable tax) Allowance

at the same time.

Background

- For marriages before 5 December 2005, the husband’s income is used to work out Married Couple’s Allowance.

- For marriage and civil partnerships after this date, it’s the income of the highest earner.

- If one of you dies or you divorce or separate, the allowance continues until the end of the tax year.

- Source: https://www.gov.uk/married-couples-allowance/what-youll-get

VAT on Disability Aids

- Zero rate VAT on disability aids.

Not need to be on benefit to be exempted from VAT on disability aids.

BACKGROUND

INCOME TAX AND PENSIONERS

INCOME TAX AND PENSIONERS

2023..."There has been a surge in the number of pensioners paying tax"...

..."The figures, published ... (June 29) 2023, revealed that in 2023/24 the number of over 65s paying income tax stood at 8.5mn, an increase of around 10 per cent on the 2022/23 figure of 7.73mn."...

..."The figure of 8.5m is exactly double the number of taxpayers that were aged over 65 in 2004/05."...

..."Laura Suter, head of personal finance at AJ Bell, said".

.."tax bands were frozen in 2021" ... “If we look over the longer term, there are now two million more pensioners paying income tax than there were when the Tories came to power in 2010. But one million of those have been dragged into the income tax net in the past two years alone, thanks to frozen tax bands.”...

.."tax bands were frozen in 2021" ... “If we look over the longer term, there are now two million more pensioners paying income tax than there were when the Tories came to power in 2010. But one million of those have been dragged into the income tax net in the past two years alone, thanks to frozen tax bands.”...

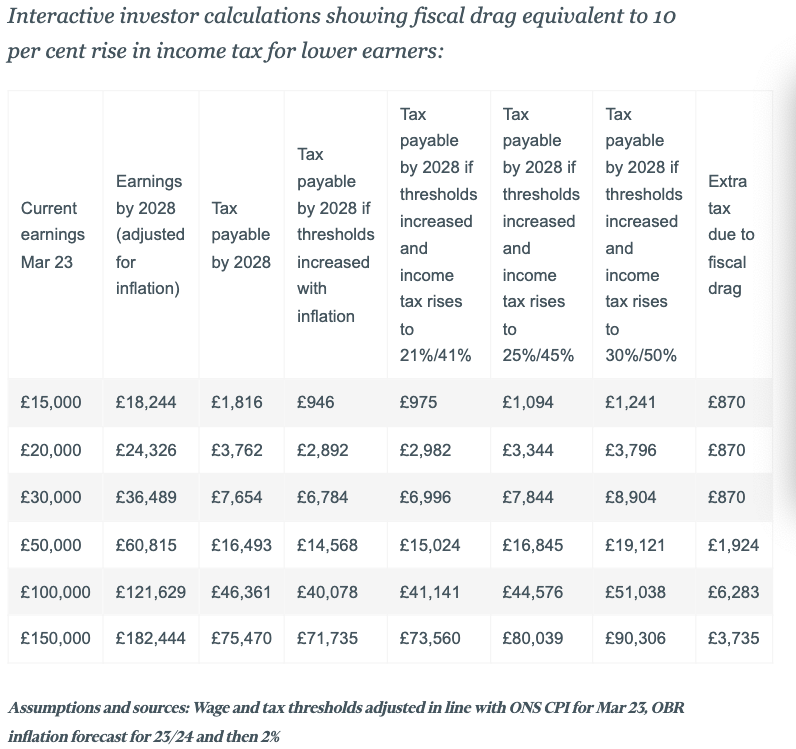

..."Interactive Investor put together some calculations showing how much tax different earners would pay.

It revealed that someone earning £20,000 in 2022/23 will pay £870 extra due to fiscal drag by 2028, equivalent to a 10p rise in income tax.

Meanwhile, someone earning £50,000 in 2022/23 will pay £1,924 extra due to fiscal drag by 2028, equivalent to a 5p rise in income tax."...

..."Alice Guy, head of pensions and savings at II, said"...

“The stark figures demonstrate the chilling effectiveness of freezing tax thresholds. The personal allowance has been frozen at around £12,500 since 2019 and is expected to remain at the same level until at least 2028.”...

You are on

Lower Pensioner Taxes page