Tax Wealthiest Companies more

More Just Taxation on Wealthiest Firms

More Just Taxation on Wealthiest Firms

More tax on big companies

More tax on big companies

TAX ON UK NORTH SEA

OIL AND GAS PROFITS

- North Sea oil and gas companies to continue to pay 30% corporation tax on their profits and a supplementary 10% rate on top of that.

- Regardless of money lost in previous years or on money spent such as on decommissioning North sea oil platforms.

Background re 12 month Windfall Tax (2022) by Tories on North Sea oil and gas companies

The important feature of this extra tax (just for 12 months) is that any money the companies may have lost in previous years, or money they are spending on things like decommissioning North Sea oil platforms cannot be used to reduce the amount of tax they pay.

In recent years, such methods have meant that BP and Shell, for example, have paid almost no tax in the UK.

Oil and gas firms operating in the North Sea are taxed differently to other firms.

Taxes on their profits are higher -

they pay 30% corporation tax on their profits and a supplementary 10% rate on top of that. Other firms pay corporation tax at 19%.

they pay 30% corporation tax on their profits and a supplementary 10% rate on top of that. Other firms pay corporation tax at 19%.

But the amount they have actually paid in the UK recently has been low.

This is because they spent enough money on things like decommissioning North Sea oil platforms to cancel out any profits they were making in the UK.

This is because they spent enough money on things like decommissioning North Sea oil platforms to cancel out any profits they were making in the UK.

BP and Shell both received more money back from the UK government than they paid every year from 2015 to 2020 (except 2017, when Shell paid more than it received).

- Background: Article 8 May 2022, in The Observer ..."BP chief executive Bernard Looney, announcing record quarterly profits of £5bn last week, said plans for “up to £18bn worth of investment” over the next eight years would go ahead even if there was a windfall tax on the companies profits. He said £2.5bn would be spent buying back shares to boost their value."...

- ..."Shell also reported a record quarterly profit of £7.3bn for the first three months of the year" ...2022.

- ..."Independent pensions consultant John Ralfe said most large final-salary retirement schemes were unlikely to hold BP or Shell shares after selling their holdings to buy safer bonds."...

- ..."“The idea that BP or Shell are widows’ and orphans’ stocks, or that pensioners rely on income from the oil giants to make ends meet, is just risible (laughable),” said Ralfe. “As an argument against a windfall tax, it has no validity whatsoever.”...

- Source Link

CORPORATION TAX

- Over 50s & Young Labouring Ages party would have Corporation Tax at 26 per cent (from unused manifesto) from 2024 or 2025 general election year, for firms with yearly profit from £251,000 upwards.

(BACKGROUND - Tory policy -

Corporation Tax on businesses contributes to government budget for education, trade training budgets and to free tuition and student grants in universities, colleges and especially medical schools to train up the very short-staffed NHS medical staff nurses.Tory government will raise Corporation Tax to 25 per cent

next April (Tory government has today, Friday 14 October 2022, announced that Corporation Tax will increase to 25% from April 2023 as already legislated for, raising around £18 billion a year).

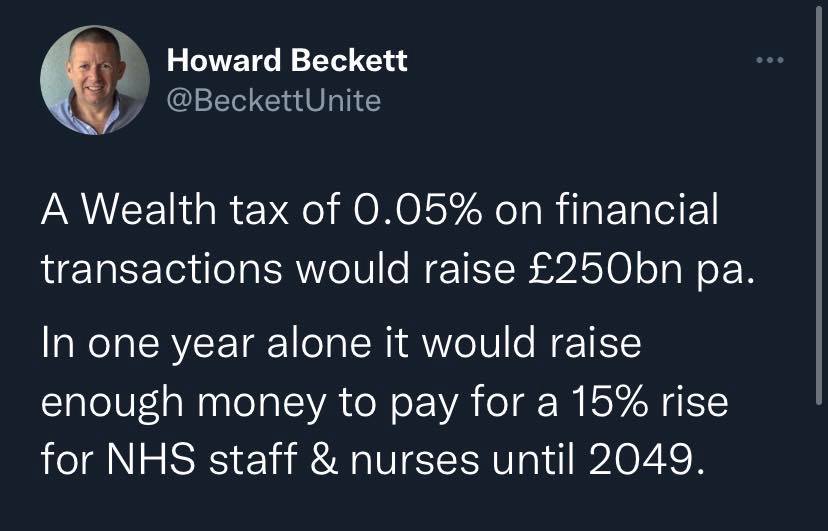

ROBIN HOOD TAX

- Financial Transactions Tax (FTT), aka

Robin Hood Tax, is a tiny tax of about 0.05% on transactions like stocks, bonds, foreign currency and derivatives

BACKGROUND – Research by the Institute for Public Policy Research (IPPR) shows that the financial sector can afford another £20 billion in tax.

A Robin Hood Tax would not just fall on UK banks like Barclays and Royal Bank of Scotland, it would also fall on foreign banks operating in the City of London such as Goldman Sachs and on hedge funds.

The IMF (International Monetary Fund) has clearly stated that FTTs exist in all the major financial centres already, without driving business away. The best example of this is the UK, where we have a stamp duty of 0.5% on all share transactions.

WON’T BANKS JUST PASS THE COSTS ON TO US?

No, because Financial Transactions Taxes (FTTs) are specifically aimed at high-frequency trading, and the customer-base of hedge funds and investment banks is comprised primarily of high net worth individuals, not ordinary people. Hedge funds, investment banking divisions of large banks, and dedicated investment banks dominate this market, and so taxes on an FTT would fall primarily on these companies and corporations.

The IMF has studied who will end up paying transaction taxes, and has concluded that they would in all likelihood be ‘highly progressive’. This means they would fall on the richest institutions and individuals in society, in a similar way to capital gains tax. This is in complete contrast to VAT, which falls disproportionately on the poorest people.

DEAL EFFICIENTLY WITH

TAX EVASION and

TAX HAVENS

DEAL EFFICIENTLY WITH

TAX EVASION and

TAX HAVENS

- Fully fund and staff HM Revenue and Customs to help against tax evasion.

TAX HAVENS AND COUNCIL & GOVERNMENT CONTRACTS

- All firms with a government or council contract over £250,000 will pay tax in UK and train UK workers.

- No company will receive taxpayer-funded contracts if it, or its parent company, is headquartered in a tax haven.

MULTINATIONAL BIG COMPANIES

- Big companies that operate in Britain will pay taxes on all operations in UK – not be able to offshore tax bill to some lower tax regime abroad.

MORE BUSINESS RATES ON RICH SHOPS, HOTELS AND BANKS

- British department stores like Harrods and Selfridges and hotels like the Savoy and the Ritz would have their business rates risen back up when lowered by up to 45 per cent in 2023 by

2022 Autumn Budget. - Bring back Bank of England’s rate up from 7% cut.

- Ending cut on property taxes on Banks based in London’s Canary Wharf, such as international bank HSBC’s building in Canary Wharf, for example, (could have) fallen by almost 7%.

Sources:

https://www.mirror.co.uk/news/politics/poll-finds-62-back-labours-28633765

You are on Tax Wealthiest Companies more page

Related Policy

You are on Tax Wealthiest Companies more page

Related Policy

-

Taxation - People

ButtonLess tax on basic waged and retired. More on the wealthiest people.

View more